Can You Swap Your Car During a Finance Agreement?

17th Jan 2025

There are several options available when you're looking to swap your car during a finance agreement. It doesn't matter whether you have a car on Hire Purchase (HP) or Personal Contract Purchase (PCP), the process is simple, as we'll explore in this handy guide.

Contents

- Is it illegal to sell a car with outstanding finance in the UK?

- How to sell a car on finance?

- How do I change my car before the end of my finance agreement?

- Can you part exchange a car on finance?

- Can you swap finance from one car to another?

- I bought a car with outstanding HP finance. What are my rights?

- Frequently Asked Questions

Is it illegal to sell a car with outstanding finance in the UK?

Technically, you’re not allowed to sell a car that is currently under an active finance agreement. This is because, until you pay off the vehicle completely, it doesn’t belong to you.

In other words, cars that have an active finance contract belong to the lender, and you are the registered keeper, who’s authorised to drive the car but don’t have legal power over it. Therefore, it’s illegal to sell an asset that doesn’t belong to you.

However, if you need to sell the vehicle you’re still paying for, there are ways to settle your debt so you can purchase another car that best suits your current lifestyle.

How do you sell a car on finance?

As previously mentioned, you can’t sell a car that is current on finance, but there are ways to settle the agreement early. There are mainly three options to terminate a finance contract, and what’s going to determine which one you can choose will depend on what type of finance agreement you have.

Voluntary Termination

This option is great for those under an HP or PCP contract.

If you’ve paid half of the total payable amount, you can apply for a voluntary termination. This means that you’ll return the vehicle to the dealership and won’t get the money you already paid back.

If you haven’t paid 50 percent yet (which includes the loan for the car, fees, interest and the balloon payment if you’ve got a PCP contract), you can choose to pay off the remainder of the 50 percent and end the contract upon return of the vehicle.

Settlement Figure

This option allows you to pay off the full loan early and take ownership of it.

For this, you’ll need to request a settlement figure where you’ll be informed of the amount you still owe (including early settlement fees and interest), and you’ll be the owner of the car after you’ve made the payment.

You can then sell the car that you own and use the money as a down payment on another vehicle, or use it as a trade in.

Refinance

If you want your monthly instalments to be lower than they currently are, you can potentially refinance your vehicle.

You’ll need to get in touch with the lender and renegotiate the finance agreement for you to pay less each month and have more time to pay it off.

How do I change my car before the end of my finance agreement?

As mentioned above, you can't legally sell a vehicle that has an outstanding finance agreement on it. Below we explain, how you can terminate your contract early, and pay off the remaining value to own the car at the end.

Step 1: Get a finance settlement figure

Firstly, you'll need to get a finance settlement figure from your lender and ensure the V5 certificate is in your name.

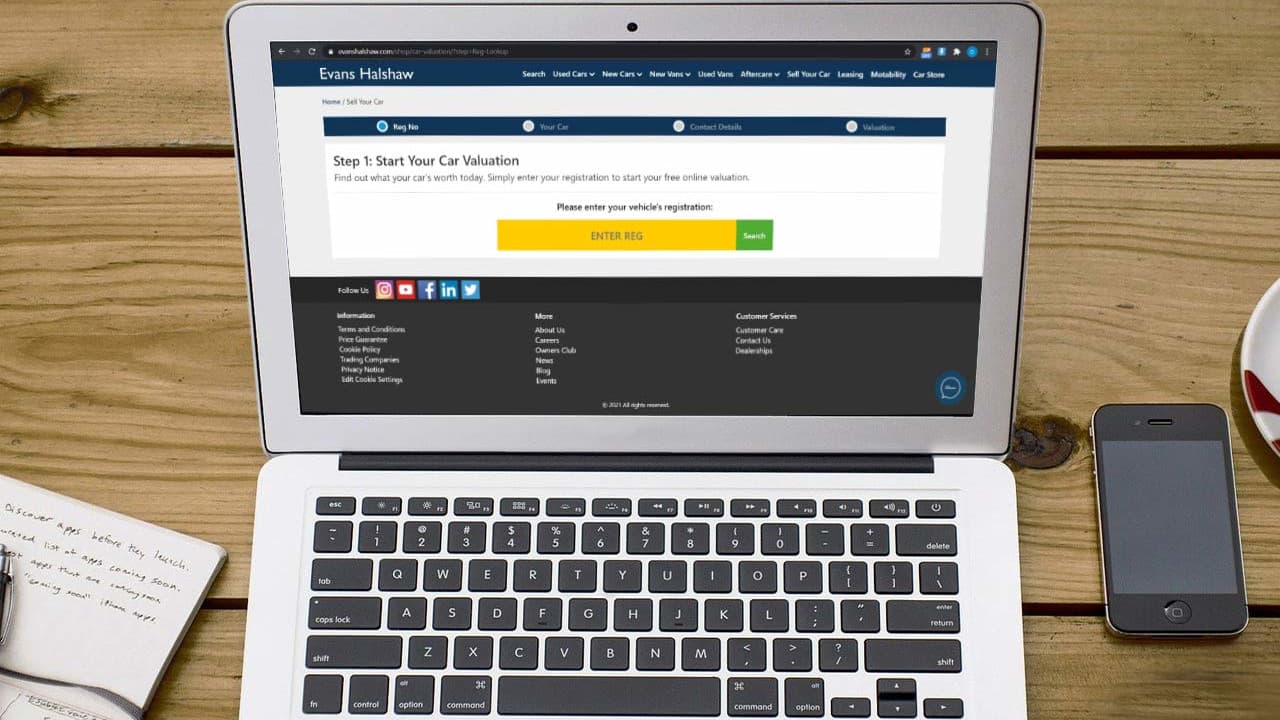

Step 2: Get your car valued

Then your car needs valuing, which is super simple with our Sell Your Car tool. All you need to do is enter your registration number and a few extra details to receive a valuation price in minutes.

Step 3: Work out your equity

Next, time for some maths. Subtract the settlement figure from your car's valuation price. This will equal the amount of equity available in your car. If you have a positive figure, then you can use this money towards the deposit on your next car.

However, if the figure is negative, you'll need to pay that amount of money on top of your new car's price. So it's still possible to swap your car, but being in negative equity can make the swap costly.

Step 4: Check your Direct Debit date

Finally, if you're paying for your current car finance by Direct Debit, it's a good idea to check what date your payments are made, as your settlement figure will continue to reduce each time you make a monthly payment.

Can you part exchange a car on finance?

Yes, it is possible to use your current financed car as a trade in to get a new one. When you take the vehicle you’d like to trade in to a dealership, the car will go through a valuation process. This is to establish how much the car is worth so they can make an offer.

This money can be used to pay off the remaining balance on your finance agreement. However, if the value offered for the trade in is inferior to the value you owe, you may be required to cover the difference out of pocket.

Alternatively, if your car valuation is superior to the outstanding balance, you can use the remaining money towards a new car.

Can you swap finance from one car to another?

Unfortunately no. Each finance agreement is tailored to the person, vehicle and their circumstances.

In this case, if you’d like to end your current contract, you’d have to get in touch with the lender and request a settlement figure, as explained above. By paying off this debt, you gain full ownership of the car and are free to do with it as you please.

If you don’t want to keep the vehicle, you can opt for voluntary termination, pay up to 50 percent of the vehicle, and return it.

I bought a car with outstanding HP finance. What are my rights?

If it’s proven that you purchased the vehicle in ‘good faith’, which means you had no reason to believe there would be a problem with the vehicle, or that you didn’t know it was still on finance, you have a good chance of keeping it legally.

You have even more of a chance if you’re a private buyer, who doesn’t buy vehicles to resell or hire them on, or if you’re the first private buyer to purchase the vehicle.

Find your next dream car at Evans Halshaw

If you're in positive equity, and you've decided on whether to upgrade your car through either a PCP or HP agreement, now it's time to find your dream car.

At Evans Halshaw we have an extensive range of new and used cars for you to browse online, or you can visit your nearest Evans Halshaw retailer.

Frequently Asked Questions

In case of death, you’ll need to write a letter explaining your relationship to the person who died and fill in the V62 form (which will allow you to apply for a new V5C logbook). When you finish filling out the documents, send them to the DVLA Sensitive Casework and pay the £25 fee.

Yes you can pay off car finance early. In this situation, you have two options. You can request a settlement figure, pay off the vehicle, and you’ll have full ownership of it in the end.

Alternatively, you can submit a voluntary termination request where you’ll have to pay, at least, 50 percent of the total amount and return the vehicle in the end.